Bitcoin market cap vs other assets

Over the past decade, the S&P 500 and Nasdaq have seen growth of 231% and 335%, respectively. However, another form of investment has seen much more impressive growth, and that is Bitcoin. In today’s article, RentFB will compare Bitcoin market cap vs other assets and predict its development in the next decade.

The evolution of Bitcoin over the past decade

Bitcoin (BTC) is the first and largest cryptocurrency, developed based on Blockchain technology. As an independent means of online payment, Bitcoin does not depend on any central bank or government. Being the first, Bitcoin is not only the first cryptocurrency in the world but also opens the way for developing the crypto market. Bitcoin operates on a peer-to-peer network, allowing senders to transact directly with recipients without going through a middleman. This eliminates unnecessary fees and makes each transaction much cheaper than international money transfers.

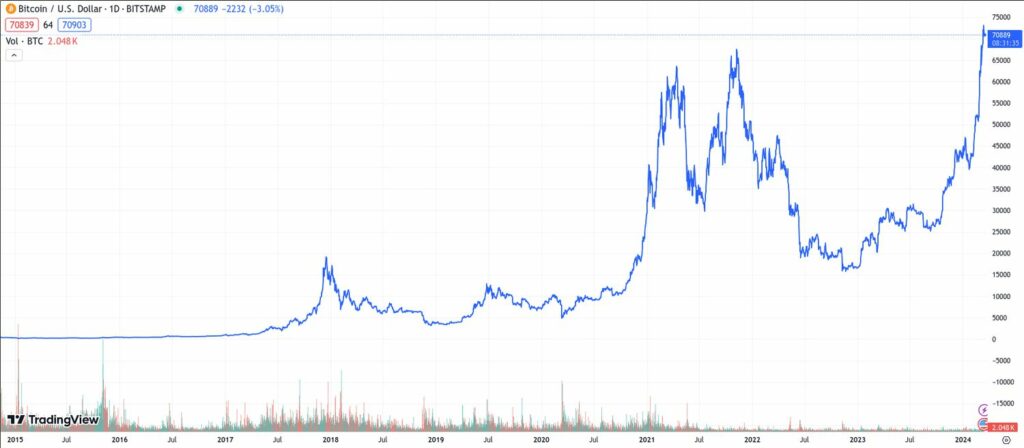

Financial experts say it is “absurd” to expect Bitcoin to continue to increase in value by 12,000% over the next 10 years, reaching nearly $150,000 per Bitcoin. The total global GDP is expected to reach just over $100 trillion by 2023, making this scenario seem unlikely. However, if you invested $1,000 in Bitcoin in April 2013, it would be worth about $121,000 today, a 12,000% increase. Converted to Vietnamese Dong, 25 million VND invested in Bitcoin in 2013 would now be worth 3,078 billion VND in April 2024. Bitcoin has evolved from a digital currency into a global asset with a market capitalization of over $1,200 billion, making it the 8th largest company in the world. Over the past decade, Bitcoin has seen wild price swings, from periods of “skyrocketing” growth to periods of more than 50% decline. Although many critics predicted that Bitcoin’s value would soon reach zero, it has continued to rise sharply.

Bitcoin’s incredible price volatility has increasingly attracted the attention of investors, thanks to its decentralized characteristics and fixed supply. Bitcoin’s spectacular price increase has also spurred the development of a financial services ecosystem that facilitates easier transactions. Earlier this year, the US Securities and Exchange Commission (SEC) approved exchange-traded funds (ETFs), and Bitcoin’s price rose 56% as of April 15, indicating growing interest in these regulated financial products.

Bitcoin market cap vs other assets

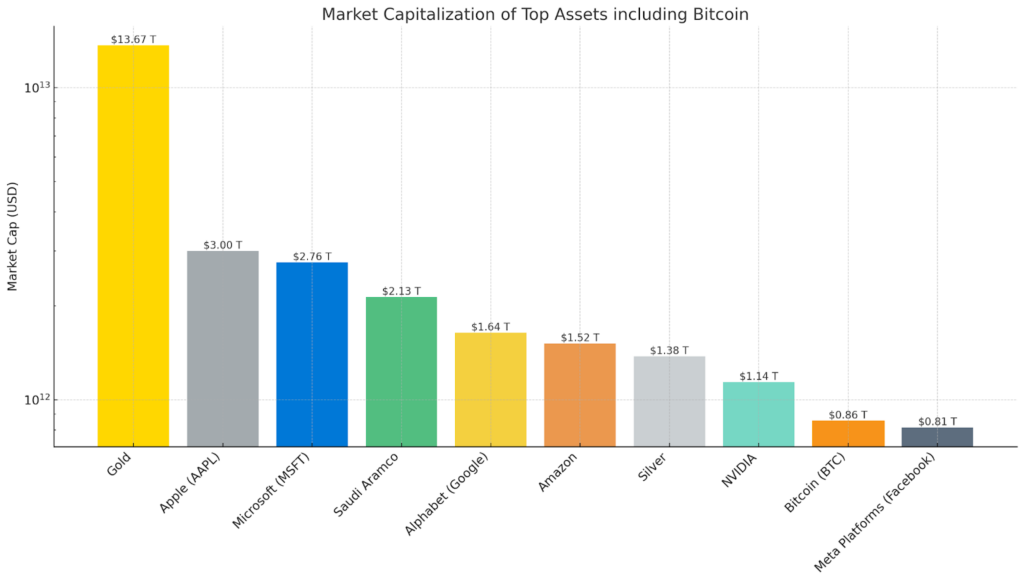

Bitcoin’s market cap now accounts for a significant portion of the total capitalization of global financial assets, indicating significant growth for the cryptocurrency compared to other traditional assets. As of now, Bitcoin’s market cap has surpassed $1.2 trillion, making it one of the largest assets in the world.

Compared to leading stock indices such as the S&P 500 and Nasdaq, Bitcoin’s market cap is showing its prominence. The S&P 500, which represents the 500 largest companies on the US stock exchange, has a market capitalization of around $40 trillion, while the Nasdaq, which focuses on technology companies, has a market capitalization of around $20 trillion. While Bitcoin has not reached the market capitalization levels of these indices, it has still shown a rapid and strong rise in recent years.

When compared to other traditional assets such as gold, Bitcoin’s market capitalization also shows competitiveness. Gold, which is considered a traditional haven, has a market capitalization of around $12 trillion. While Bitcoin is far from gold’s market capitalization, its steady rise in value and adoption is attracting significant attention from investors and financial institutions. Even when compared to the world’s largest companies such as Apple and Microsoft, Bitcoin’s market capitalization is not far behind. Apple, with a market capitalization of around $2.5 trillion, and Microsoft, with a market capitalization of around $2.3 trillion, are the leading technology companies, but Bitcoin is rapidly growing to become a powerful global asset.

Bitcoin’s rising market capitalization reflects not only its growing acceptance among investors but also the cryptocurrency’s potential to shape the future of global finance. As more companies and institutions invest in Bitcoin and related financial products, Bitcoin’s value and influence continue to grow, highlighting its importance in the global financial landscape.

Will Bitcoin still grow in the next 10 years?

Despite Bitcoin’s impressive growth, financial experts warn that expecting the price of Bitcoin to increase by 12,000% in the next 10 years, reaching nearly $150,000 per Bitcoin, is “absurd.” The total global GDP in 2023 is just over $100 trillion, so this hypothesis seems unrealistic.

Bitcoin’s main appeal is its fixed supply. The total number of Bitcoins is capped at 21 million BTC, a number that cannot be changed, even by its founder Satoshi Nakamoto. As of April 2024, about 19.7 million BTC have been mined, leaving only about 1 million BTC left to be mined. After the next halving, Bitcoin’s supply growth rate will drop to less than that of gold. Halving is the process of periodically reducing the block subsidy given to miners, ensuring a stable issuance rate until the maximum supply is reached.

When the supply of an asset is scarce and all other factors remain unchanged, the value of that asset typically increases as demand increases. Technical experts predict that Bitcoin could follow a similar path. However, Bitcoin’s supply is also dependent on cryptocurrency mining companies, and information about inventory and supply is limited. If miners sell their reserves, this could put downward pressure on prices.

After hitting a record high last month, Bitcoin’s price recently fell below $64,000. Analysts at JP Morgan predict that prices could continue to fall after the halving. A common reason for this year’s surge was the approval of a Bitcoin ETF by the US Securities and Exchange Commission (SEC) in January, along with expectations that central banks would cut interest rates. However, there is no clear evidence that previous halvings have driven Bitcoin’s next rally.

Studies of previous halvings show that: After the supply reduction on May 11, 2020, Bitcoin’s price increased by about 12% in the following week and 659% in the following 12 months. However, this recovery can be explained by other factors such as loose monetary policy and Covid-19 lockdowns, which left many investors with more cash. There is no clear evidence that the halving has directly impacted Bitcoin’s price.

The previous halving in July 2016 also saw Bitcoin increase by about 1.3% in the following week before falling and then rising again. It is difficult to assess and determine the impact of a supply reduction on the price of Bitcoin and the cryptocurrency market in general, so investors should be cautious with this asset.

In Vietnam and many other countries, Bitcoin (as well as some other virtual currencies) is not recognized by law as a legal means of payment. Therefore, Bitcoin transactions in Vietnam are illegal and can be subject to administrative sanctions or criminal prosecution, depending on the severity of the violation.

Currently, only two countries recognize Bitcoin as a legal currency: El Salvador and the Central African Republic. El Salvador’s Congress passed a bill in 2021, officially recognizing cryptocurrencies as a legal form of exchange of value. The Central African Republic has followed in the footsteps of El Salvador and accepted Bitcoin as a legal means of payment in Q2 2022. Hopefully, the content that RentFB has summarized will give you the most general view of the investment capitalization of the Bitcoin market compared to the remaining markets.

Contact Info

You need a Facebook advertising account but don’t know any reputable provider. Coming to

Rentfb is where you will experience what you need facebook dropship ads prestige, high trust, and professional consulting and service support for customers.

Frequently asked questions

The World Market Capitalization Rankings provide an overview of the size and financial strength of the world’s leading companies. As of now, major technology companies such as Apple, Microsoft, and Alphabet top the rankings, with outstanding market capitalizations that regularly reach trillions of dollars. Apple, with its continuous growth in revenue and profits from products such as the iPhone and financial services, continues to maintain its number one position. Microsoft, thanks to the strong development of its Azure cloud platform and popular software products, holds the second position. Alphabet, the parent company of Google, ranks third thanks to its leadership in online advertising and innovation. In addition to these three technology giants, oil and gas, financial, and consumer companies also occupy important positions in the rankings, with great influence on the global economy. The constant changes in this ranking reflect the fluctuations in the global economy and the continuous development of key industries.

The World’s Top 10 Assets include prominent names from different sectors, reflecting global power and influence. In terms of market capitalization, technology companies such as Apple, Microsoft, and Alphabet top the list, thanks to continuous innovation and growth in the digital industry. Oil and gas corporations such as Saudi Aramco and ExxonMobil also occupy important positions thanks to their control of global energy resources. Meanwhile, large banks such as JPMorgan Chase and Bank of America stand out in the financial sector. In addition, consumer and commodity companies such as Amazon and Berkshire Hathaway also make the list thanks to their stability and global expansion. These assets not only demonstrate financial strength but also have a profound influence on the global economy and markets.